cryptocurrency

Cryptocurrency

There are other ways to manage risk within your crypto portfolio, such as by diversifying the range of cryptocurrencies that you buy. Crypto assets may rise and fall at different rates, and over different time periods, so by investing in several different products you can insulate yourself — to some degree — from losses in one of your holdings https://best-aucasinosites.com/.

Cryptocurrencies are supported by a technology known as blockchain, which maintains a tamper-resistant record of transactions and keeps track of who owns what. The use of blockchains addressed a problem faced by previous efforts to create purely digital currencies: preventing people from making copies of their holdings and attempting to spend it twice

Legal tender: You might call them cryptocurrencies, but they differ from traditional currencies in one important way: there’s no requirement in most places that they be accepted as “legal tender.” The U.S. dollar, by contrast, must be accepted for “all debts, public and private.” Countries around the world are taking various approaches to cryptocurrency. For now, only one country, El Salvador, accepts Bitcoin as legal tender. In the U.S., what you can buy with cryptocurrency depends on the preferences of the seller.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.

For shorter-term crypto investors, there are other risks. Its prices tend to change rapidly, and while that means that many people have made money quickly by buying in at the right time, many others have lost money by doing so just before a crypto crash.

Pi network cryptocurrency

The project’s whitepaper states that its mission is to fulfill the core principles of cryptocurrency as envisioned by Bitcoin’s anonymous creator, Satoshi Nakamoto—returning financial power to the people.

The Pi Network team has also implemented a major technical upgrade that significantly increases the migration speed to the mainnet. This upgrade optimizes the migration algorithm, making the process more efficient and allowing the network to handle more migration requests than it receives daily.

In addition to KYC, Pi Network has been actively seeking partnerships with businesses from various sectors, including crypto services, fintech, and retail. The aim is to build an ecosystem where Pi coins can be used in real-world applications such as decentralized apps (dApps), smart contracts, and retail transactions. These alliances could play a crucial role in creating utility for Pi coins once they are tradable on exchanges, so this expansion is viewed as a strategic move to position Pi Network as a major player in the Web3 space .

The project’s whitepaper states that its mission is to fulfill the core principles of cryptocurrency as envisioned by Bitcoin’s anonymous creator, Satoshi Nakamoto—returning financial power to the people.

The Pi Network team has also implemented a major technical upgrade that significantly increases the migration speed to the mainnet. This upgrade optimizes the migration algorithm, making the process more efficient and allowing the network to handle more migration requests than it receives daily.

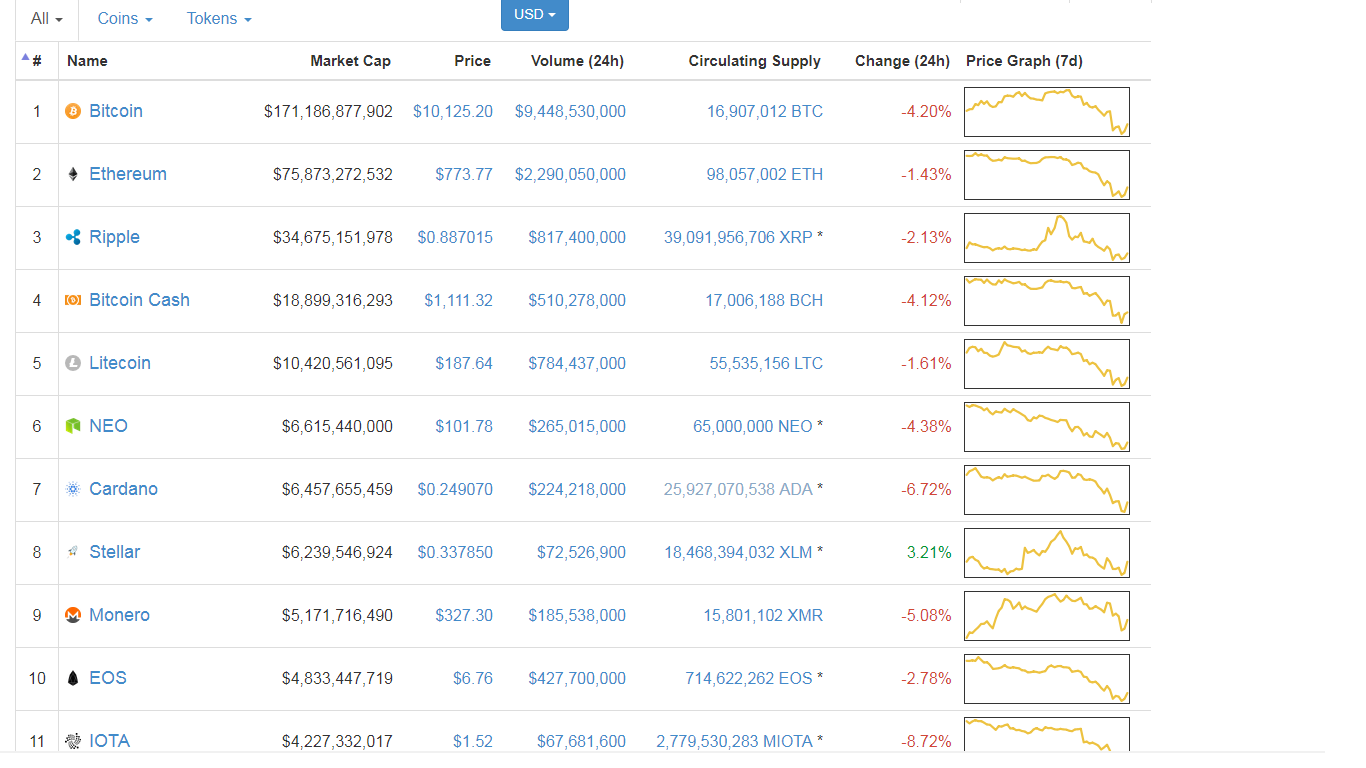

Top cryptocurrency

A distributed ledger is a database with no central administrator that is maintained by a network of nodes. In permissionless distributed ledgers, anyone is able to join the network and operate a node. In permissioned distributed ledgers, the ability to operate a node is reserved for a pre-approved group of entities.

Unlike some other forms of cryptocurrency, Tether (USDT) is a stablecoin pegged to the value of US$1. This is achieved by having a 1-1 backing between the token and USD which hypothetically keeps a value equal to one of those denominations because one token should always be able to be redeemed for one dollar. In theory, this means Tether’s value is supposed to be more consistent than other cryptocurrencies, and it’s favoured by investors who are wary of the extreme volatility of other coins.

Somewhat later to the crypto scene, Cardano (ADA) is notable for its early embrace of proof-of-stake validation. This method expedites transaction time and decreases energy usage and environmental impact by removing the competitive, problem-solving aspect of transaction verification in platforms like bitcoin. Cardano also works like Ethereum to enable smart contracts and decentralized applications, which ADA, its native coin, powers.

A distributed ledger is a database with no central administrator that is maintained by a network of nodes. In permissionless distributed ledgers, anyone is able to join the network and operate a node. In permissioned distributed ledgers, the ability to operate a node is reserved for a pre-approved group of entities.

Unlike some other forms of cryptocurrency, Tether (USDT) is a stablecoin pegged to the value of US$1. This is achieved by having a 1-1 backing between the token and USD which hypothetically keeps a value equal to one of those denominations because one token should always be able to be redeemed for one dollar. In theory, this means Tether’s value is supposed to be more consistent than other cryptocurrencies, and it’s favoured by investors who are wary of the extreme volatility of other coins.

Somewhat later to the crypto scene, Cardano (ADA) is notable for its early embrace of proof-of-stake validation. This method expedites transaction time and decreases energy usage and environmental impact by removing the competitive, problem-solving aspect of transaction verification in platforms like bitcoin. Cardano also works like Ethereum to enable smart contracts and decentralized applications, which ADA, its native coin, powers.

Leave a Reply